In the last few months, economists have become increasingly concerned about the state of the global economy. It is believed by many US economists that a global recession is imminent, with the US being the first victim. Whilst Australia appears to have a low unemployment rate and relatively stable growth, the recent 5.1% inflation announcement and interest rate hike to 0.35% have raised questions about how sustainable the Australian economy truly is. As such, the inflation announcement also raised questions about how appropriate the current minimum wage of $20.33 is in Australia, with many households unable to afford groceries and individuals unable to pay rent. This week’s article will assess whether a recession is on the horizon in Australia and will determine whether the minimum wage needs to be updated to keep up with rising inflation levels.

It’s only been two years since Australia’s last technical recession. Are we going to see another recession in the coming months?

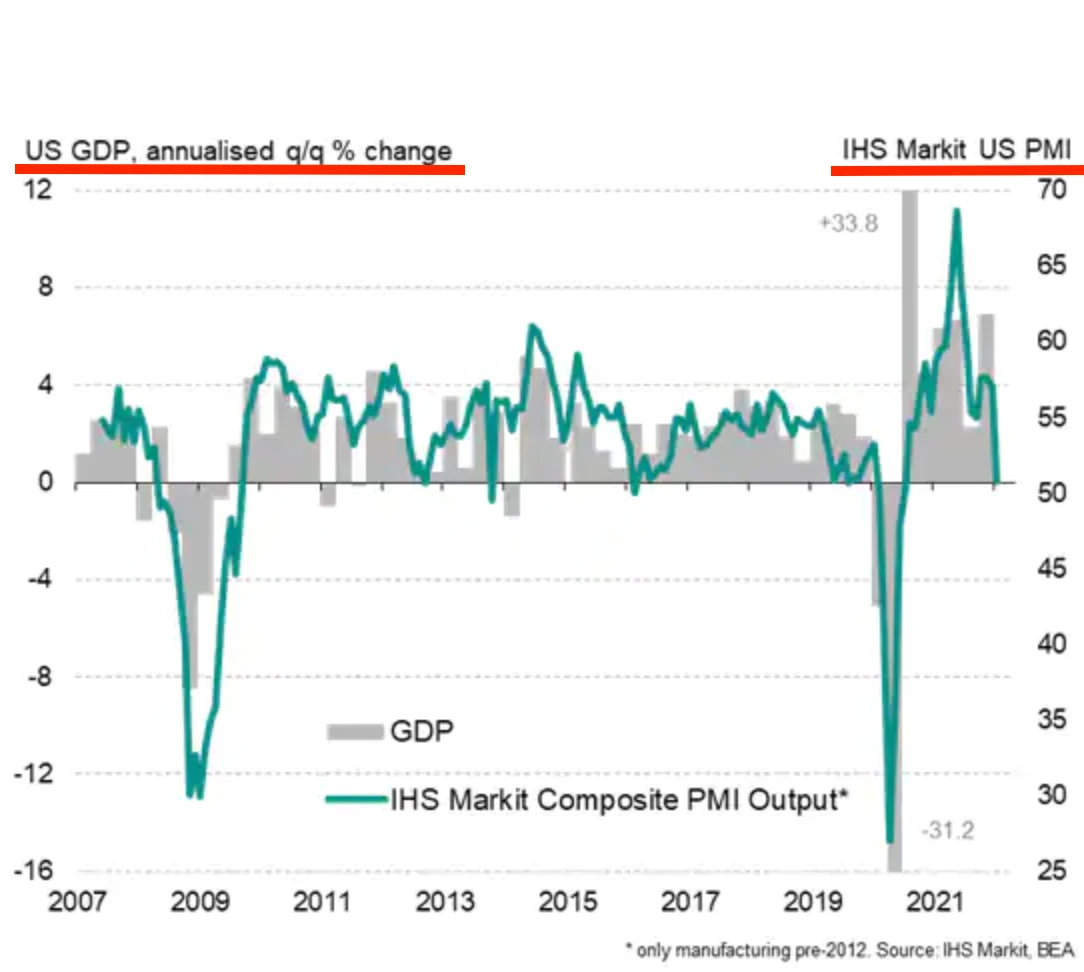

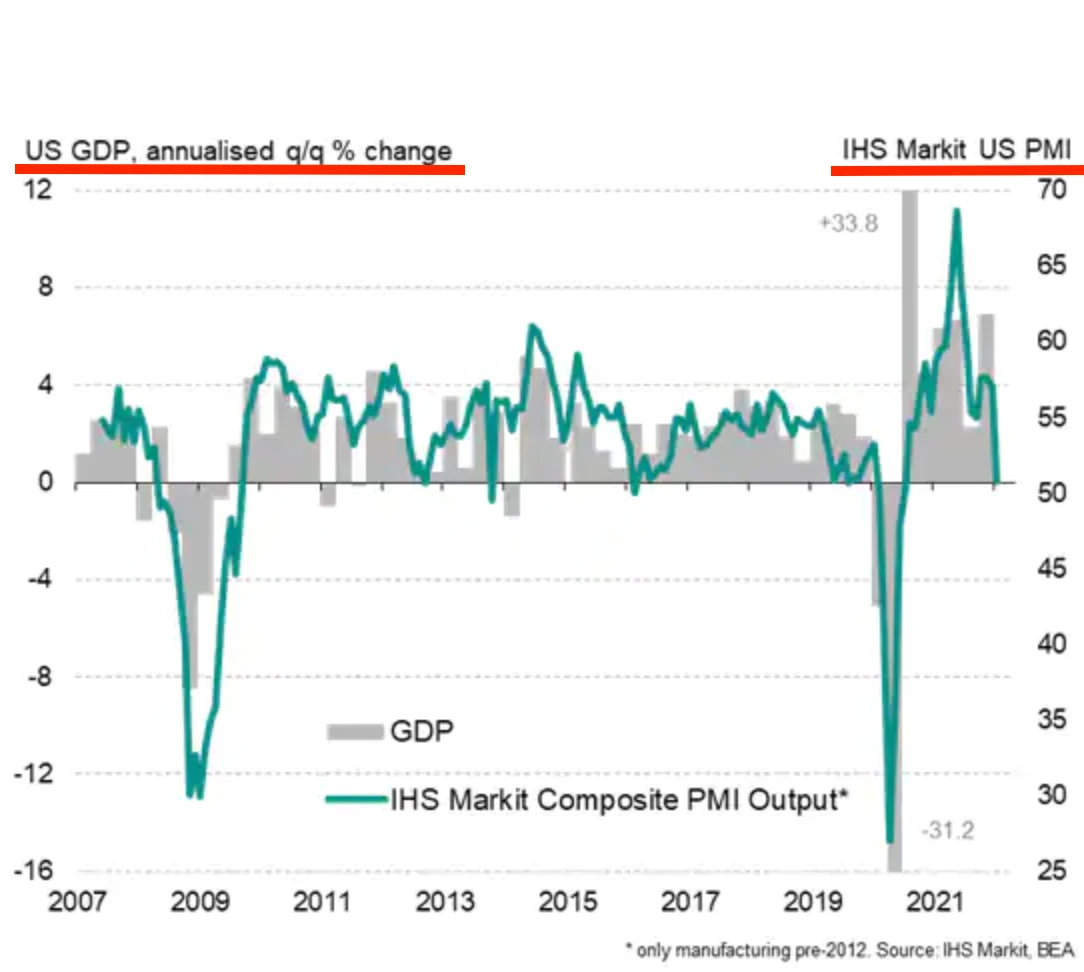

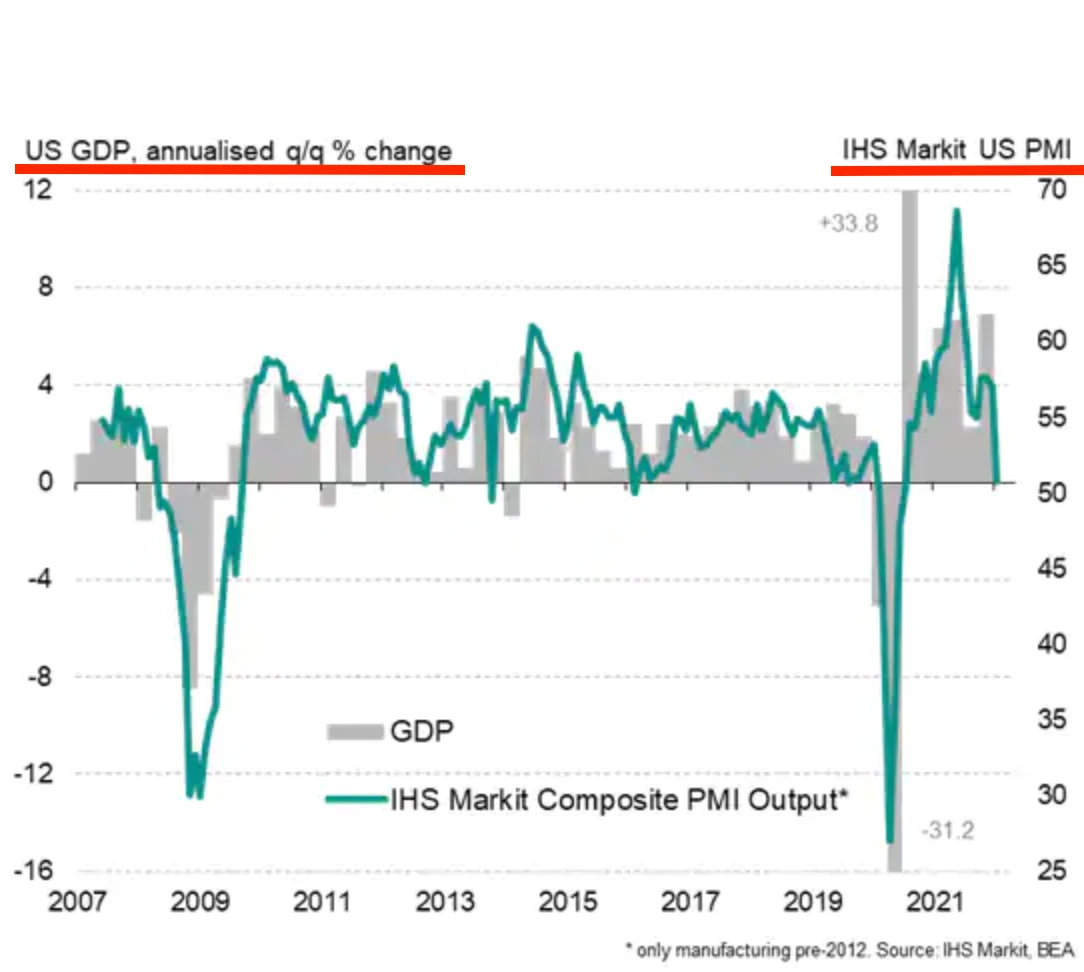

Yesterday, Goldman Sachs Senior Chairman Lloyd Blankfein noted that a US recession is imminent and is a “very, very high risk”. Excessively high fuel prices and aggressively contractionary monetary policy by the US Federal Reserve have translated to low consumer confidence, with consumer sentiment declining to its lowest level since 2011. As a result, Goldman Sachs is predicting GDP to expand by 2.4% in the US, contrary to the original 2.6% estimate.

Moreover, the 2023 predictions have fallen by 0.6%, now expecting GDP to increase by 1.6%, rather than 2.2%. Whilst this may seem irrelevant and disconnected from Australia’s economy, it shows that there is a high level of dissatisfaction with the current state of the US economy. When major banks begin to predict a recession, it often leads to a mass sell-off of equities amidst growing uncertainty, causing stock markets to take enormous hits. Ironically, just talking about a recession can cause a recession.

In Australia, economists are concerned about how quickly the RBA intends to hike interest rates over the next few years. It is believed that Australia’s cash rate will surge above 3% by the end of 2023. Yet, the current cash rate is only 0.35%. This means there could be more than ten separate interest rate hikes in the next two years. This is a big concern for both the US and Australia. When interest rates are raised, it is designed to increase the cost of borrowing, incentivise saving and reduce spending. This is ideal for the US and Australia, both of whom have excessively high inflation rates that exceed 5%.

Yet, the issue lies with the speed at which interest rates are increased. When interest rates rise too quickly, borrowing becomes too expensive for most citizens and the economy is increasingly likely to grind to a halt. Rapid interest rate increases mean there is little time for the central bank to properly assess how effective each individual interest rate change is. Since monetary policy decisions tend to have an impact lag of 6-18 months, these rapid changes create a lot of issues and eventually, may result in a technical recession.

It should also be noted that the proposed 3% interest rate should result in property prices falling by 15%, contrary to recent trends amidst COVID-19. Due to the magnitude of this price drop, Australian consumers are bound to cut back on spending, as the value of their assets deteriorates and their overall wealth plummets. As a result, Australian economists have issued similar concerns to Blankfein, with Angus Coote, co-founder of Jamieson Coote Bonds, stating that there “is a pretty decent chance of Australia going into recession”. Therefore, it has been argued that the RBA needs to slow down and hike interest rates gradually in order to mitigate the threat of a recession.

What do we expect to happen to the minimum wage amidst the growing cost of living?

Given the recent 5.1% rise in inflation levels, questions have been raised about the suitability of the $20.33 minimum wage in Australia. Usually, the minimum wage is adjusted each year to account for inflationary changes and is moderated by the Fair Work Commission. Yet, the Leader of the Opposition and prospective Australian Prime Minister, Anthony Albanese has insisted that a 5.1% minimum wage increase will be delivered to minimum wage workers. This roughly translates to a minimum wage increase of $1 for those workers. Alternatively, the ACCI has proposed a lift in minimum and award wages of up to 3%, slightly lower than the proposed 5.1% increase by Anthony Albanese.

In theory, a minimum wage rise should add to inflationary pressures. Usually, when the minimum wage is increased, it increases the cost of labour for businesses, especially small businesses. This translates to a form of inflation called “cost-push inflation” and results in businesses jacking up the prices of goods and services, passing on the additional cost to consumers in the form of higher prices. Then, this creates another issue. As the minimum wage has pushed inflation higher, workers should demand an even higher minimum wage to respond to the rising cost-push inflation caused by the original minimum wage increase. This leads to what is known as a “wage-price spiral”, whereby initial minimum wage increases translate to higher inflation levels and a spiral of wage increases.

According to Alison Pennington, a senior economist at the Centre for Future Work, a wage rise above the 5.1% inflation rate is “entirely reasonable” and is suitable amidst soaring inflation levels. However, economist Steven Hamilton from George Washington University argues that a wage increase below the inflation rate is a “good middle ground for this year” to avoid future inflationary pressures. Rather, Hamilton proposes above-inflation wage increases in the next two years to “smooth out the wage impact” over time and to properly assess the short- to medium-term implications of a below-inflation wage increase in the next year.

Clearly, economists are unsure whether the wage increase should be greater than inflation rates or less than inflation rates. Pennington also disputes the wage-price spiral theory, stating that “unless wages are outpacing productivity, real wage increases should not drive up inflation”. Right now, it is hard to determine whether the minimum wage increase will have catastrophic effects. Therefore, it is best to wait until the Federal Election results come through and to wait until the minimum wage has actually changed. Then, we can properly determine whether a minimum wage increase is beneficial or detrimental to the Australian economy.