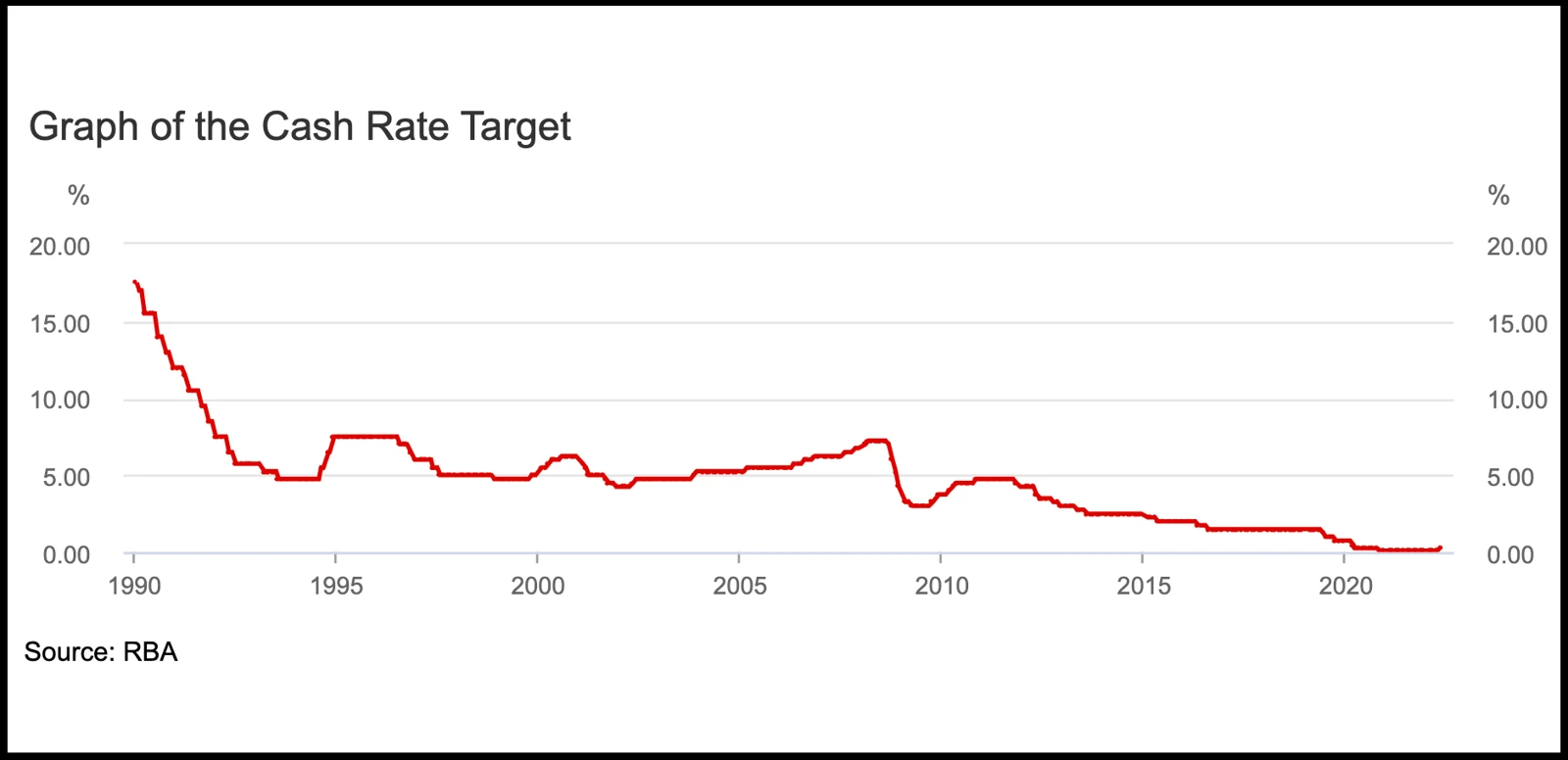

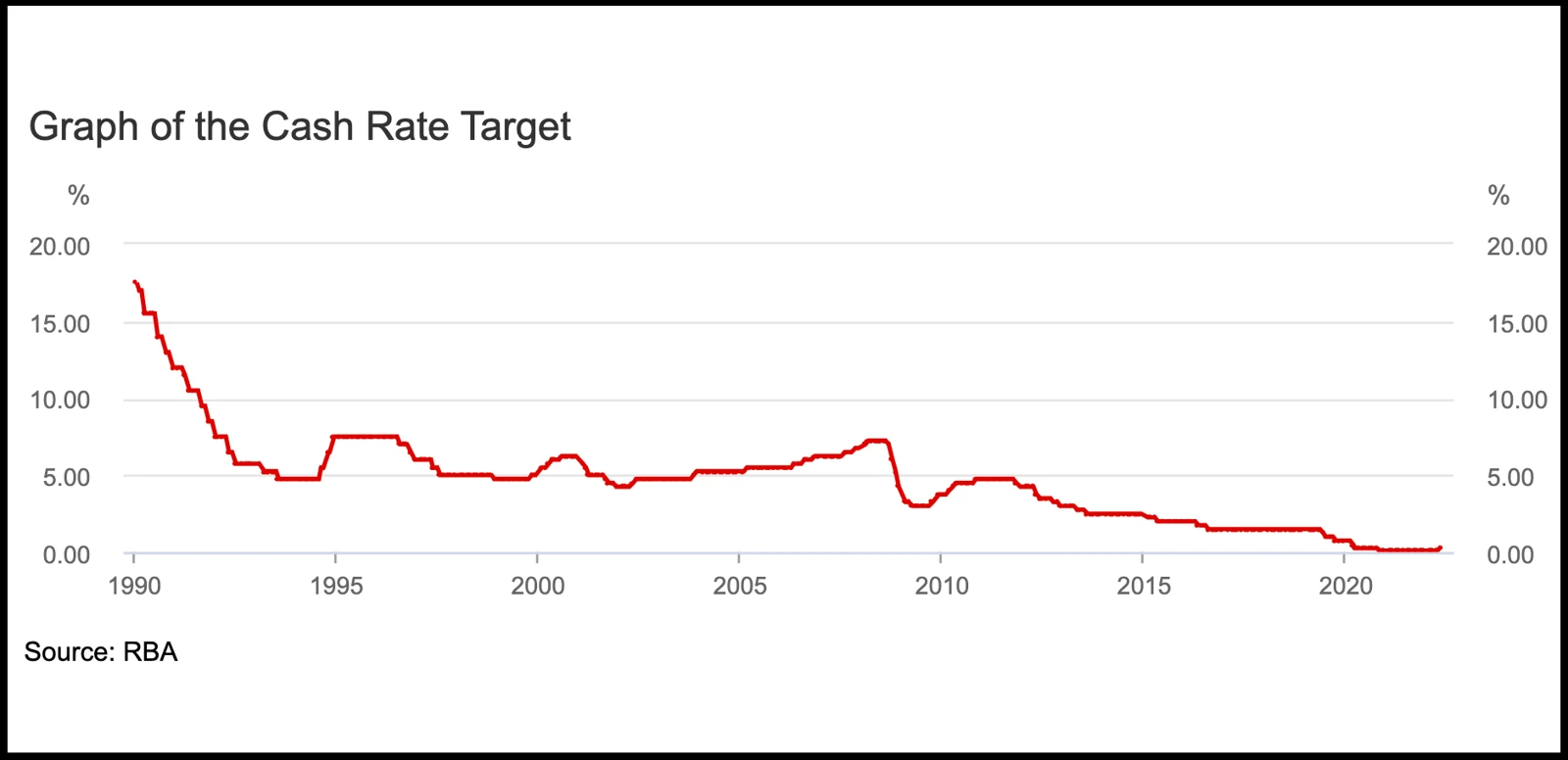

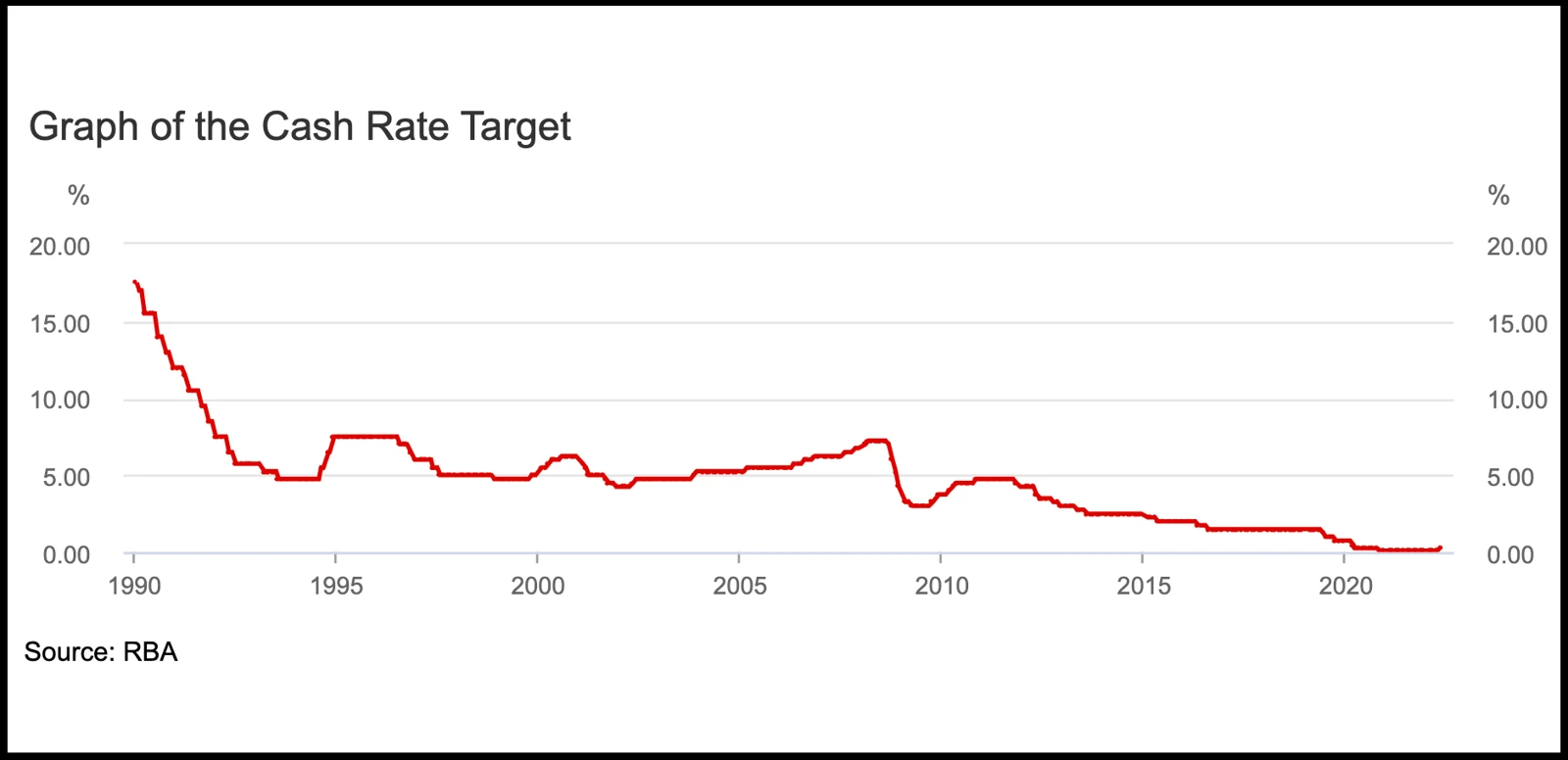

Since November 2010, the RBA has pursued an expansionary monetary policy, continuously reducing interest rates in an attempt to stabilise inflation levels at 2-3% and to achieve sustainable economic growth of 3-4% in line with the 1997 Mortimer Report. Back in November 2010, the RBA made the decision to hike the cash rate up .25 basis points to 4.75% amidst heavy spending and a strong economic recovery following the GFC. Effective as of May 3rd, the RBA has finally returned to their contractionary stance and decided to increase the cash rate to 0.35%. This is an immediate response to the growing concerns over outrageously high inflation rates, with Australia achieving an annual inflation level of 5.1% last week. Naturally, the RBA has responded by hiking up the cash rate to increase borrowing costs for borrowers and to reduce spending across the board, hoping to re-stabilise inflation at 2-3%. However, is this actually going to happen? In this week’s article, we will analyse the significance of the cash rate decision and determine its potential implications for Australia.

The significance of the interest rate hike and the effect it will have on Australia

The interest rate hike is the first since 2010. Originally, the RBA planned to hike interest rates in 2024 and planned to keep the cash rate at 0.10% for a couple of years. However, the recent surge in inflation and the declining level of unemployment led them to re-schedule their interest rate hike to May 2022. With unemployment expected to reach 3.5% in early 2023 and inflation expected to reach 6% (year-end), the interest rate hike was certainly on the cards.

So what will happen to Australia as a result? For those looking to purchase a home, you may be in luck. And for those looking to sell their home, now may be the time to act before the market overflows. Tim Lawless, the research director at CoreLogic, argued that higher interest rates should put downward pressure on house prices. Lawless also notes that major capital cities are already experiencing a contraction in house prices due to affordability issues, higher fixed mortgage rates and low consumer sentiment. Ultimately, lower prices are a result of higher borrowing costs. In theory, more expensive borrowing (a result of higher interest rates) reduces the total amount of borrowers and the total number of prospective homeowners, placing downward pressure on house prices.

Mark Bainey, Chief Executive of Capio Property Group, argues that the initial shock of an interest rate change will slow the market and “put a handbrake on house prices”. Whilst the interest rate hike was minor, it is a sign of things to come. AMP have projected the cash rate to rise to 1.5% by year-end and to 2% by mid next year. As such, AMP also notes that the recent change in monetary policy is unlikely to completely de-rail the economy but should add to the slowdown of home prices, where dwelling prices are expected to fall 10 to 15% by 2024.

Beyond house prices, how will the interest rate hike impact everyday spending and inflation in the economy? Australia’s inflation is largely driven by supply-side shocks. The COVID-19 pandemic distorting global supply chains, the war in Ukraine and the Northern NSW floods have placed upward pressure on costs. Since monetary policy targets demand by influencing the cost of borrowing, it is highly unlikely that this interest rate hike will deprecate the Australian economy and dramatically reduce inflation in the short term. With unemployment at 4.0% and economic growth at 4.2%, the impact of monetary policy on Australia’s demand is unclear.

How the interest rate hike will impact you and the people around you

One of the biggest concerns about the recent RBA decision is the impact higher interest rates will have on variable loans and mortgage repayments, especially for low-income households. As per a recent ABC article, approximately 280,000 Australians have borrowed six or more times their income, often with loan-to-value ratios of more than 90%. In simple terms, this means that 280,000 Australians technically own less than 10% of their property, having to borrow the remaining 90% in order to pay off their mortgage.

Rising borrowing costs make it more difficult for these individuals to borrow and effectively pay off their mortgages. Whilst higher interest rates are a good thing for those with savings, super and assets (they earn more interest), this is a benefit that is going to be reaped by high-income earners. High-income earners are able to save a greater proportion of their income as they earn more, meaning they can allocate a greater amount to savings, super and assets, generating greater returns on investment via interest.

However, this is a slightly dramatic conclusion. Since the cash rate has only increased by 0.25%, the monthly payment on a $600,000 home loan should only increase by $74, according to The Guardian. And for those with a $1m home loan, repayments rise by $130 a month. Compared to what is happening in the US, this change to home loan repayments is minor.

In the US, the Federal Reserve just hiked interest rates by 0.5% to a new target range of 0.75% to 1%, which is the largest hike in 22 years. This was a direct response to the 8.5% rise in inflation over the past year, which is noted as the “biggest price rise seen in 40 years”. Mortgage rates in the US now average 5.22% as of late April, which is a stark contrast to the sub-5% rates in March. With the recent interest rate hike, mortgage rates will undoubtedly rise even further.

Going back to Australia’s situation, falling house prices have actually increased the optimism of prospective homeowners. Domain has noted that there may be panic-selling of houses prior to the election and following the RBA decision, which increases available choices for prospective homeowners and should reduce the cost of purchasing a home. Whilst mortgage repayments are more expensive, as noted before, the rate at which they have increased is relatively minor and won’t have a drastic effect on those with mortgages in Australia.