Over the past two weeks, there have been some exciting announcements about the future of the Australian economy. Not only did the new Labor Government introduce their first Federal Budget, but recent announcements about soaring inflation and declining growth statistics have re-ignited conversations about an impending recession to occur in Australia next year. Whilst certain portions of the population are bound to benefit from the revised Budget, the ABC argues that there are several groups who have been left out of the most recent budget. And whilst the RBA recently increased the cash rate by a mere 0.25%, the revised inflation statistic may signal a switch back to consistent 0.50% cash rate hikes. This fortnight’s article will analyse some of the larger policies announced in the most recent Budget, as well as explain why inflation has spiked towards the end of 2022.

Who benefits from the recent Federal Budget?

Since the election of Anthony Albanese, everyone has been dying to hear about the revised Federal Budget. Economic conditions have changed drastically since the Coalition Government’s Federal Budget was released earlier this year. As per The Guardian, the March Budget had inflation of 3.5% and a cash rate of 0.1%. Now, inflation has reached a high of 7.3% and the cash rate is 2.6%, with both expected to continue rising as we enter 2023.

Firstly, let’s discuss the projected budget outcome and the Government’s expectations for the near future. The Budget projects a deficit of $36.9 billion, contrary to the forecast of $78 billion earlier in the year. Jim Chalmers admitted that Australia’s economy is likely to bear the brunt of rising inflation and slowing growth in the immediate future, with a forecasted global downturn on the horizon. The new Budget suggests that GDP growth will fall by 0.25% to 3.25% in 22/23, before falling again to 1.5% in 23/24.

Secondly, as per the ABC, the Budget has several key ‘winners’. Families will benefit from the $4.7 billion spend on childcare, providing subsidies to families and easing cost of living pressure for young families. As such, the Government has proposed that from July next year, it will increase the amount of Paid Parental Leave to a total of 26 weeks by 2026. Another key winner is the environment. The Budget is planning to dedicate $2.3 billion toward the environment, replicating the amount spent on skills development. This money will be dedicate toward previously-cut initiatives, such as Environmental Justice Australia, as well as toward the protection of threatened species, in a broader attempt to reduce negative externalities and preserve the Australian landscape.

However, the ABC also argues that the Budget has several key ‘losers’. Beyond the broader economy, it is expected that wage growth will not match inflationary pressures until next year. Whilst it was originally anticipated that inflation would reach 7.75% in December, the recent announcement of 7.3% inflation may require a re-assessment of that projection, signalling that inflation may reach >8% before 2023. According to Greg Jericho of The Guardian, real wages in June next year will be 5% below what they were in June 2019, which Jericho labels a “historic smashing of living standards”. Moreover, despite more than 2 million Australians accessing Medicare-subsidised psychology sessions, the Budget failed to include any provisions to extend the program in 2023. Therefore, there is no clear outline in the recent Budget that properly addresses the needs of those seeking treatment for their mental health.

Interested in Economics tutoring? Come enrol in Economics classes at Project Academy! Other subject classes are available too!

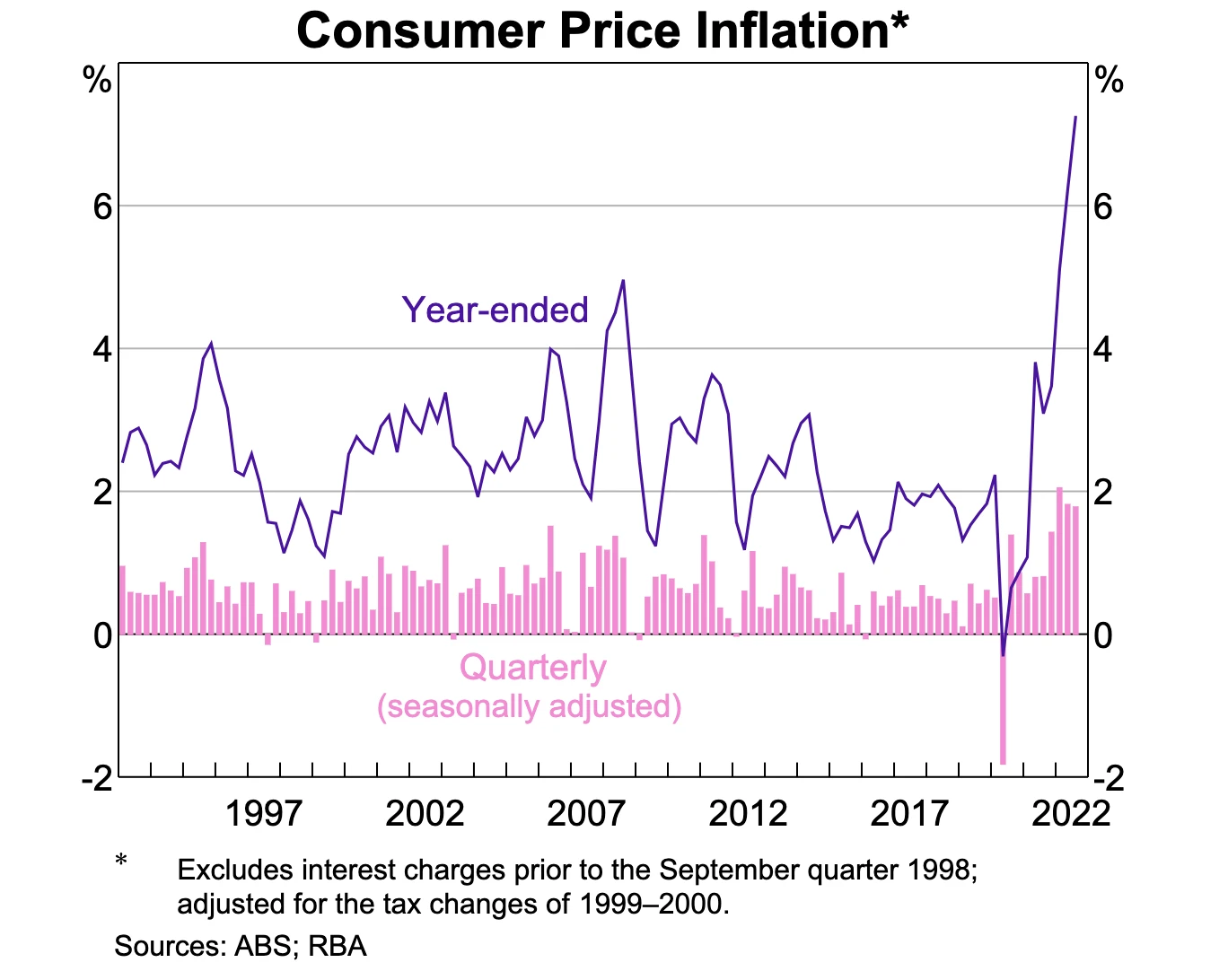

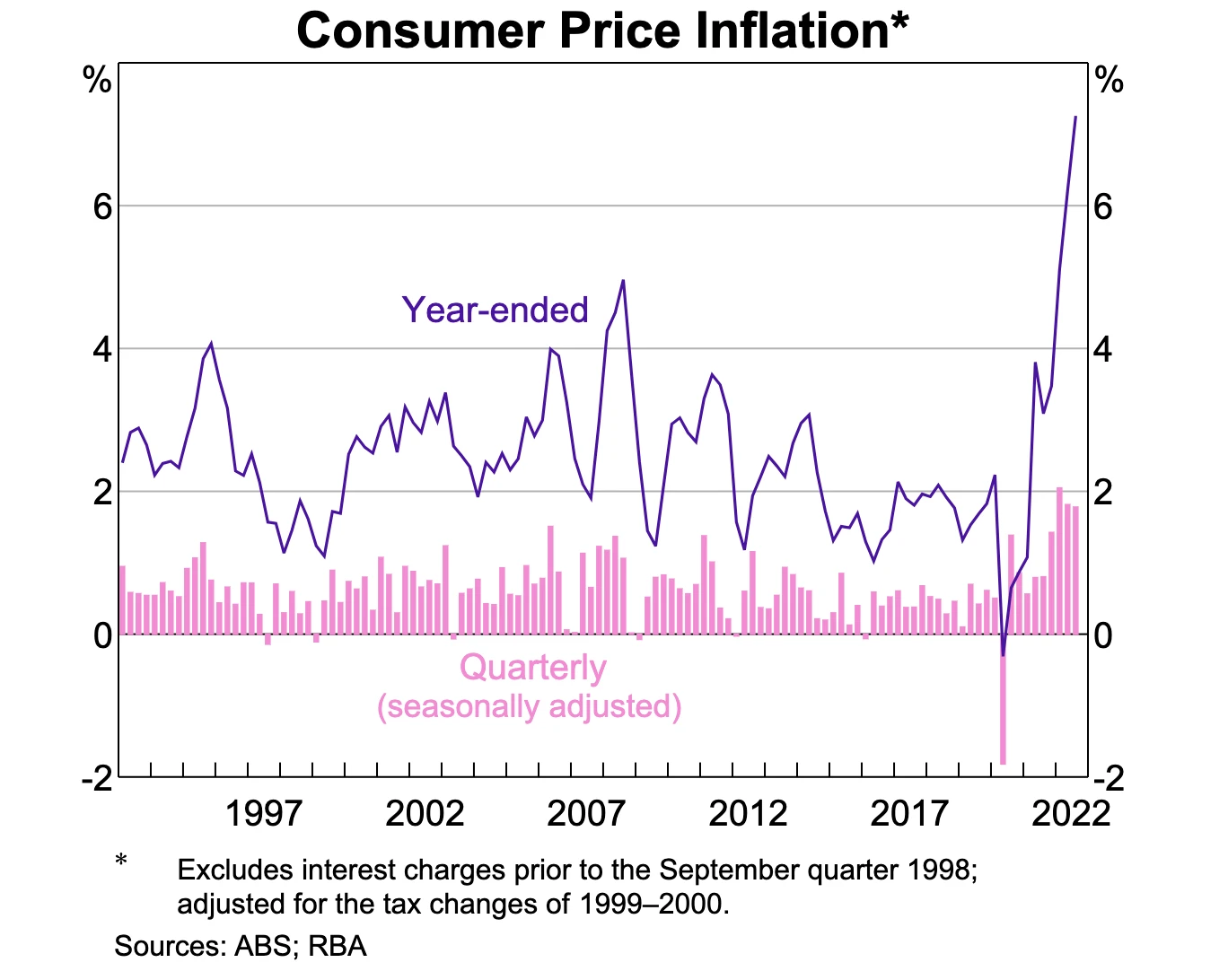

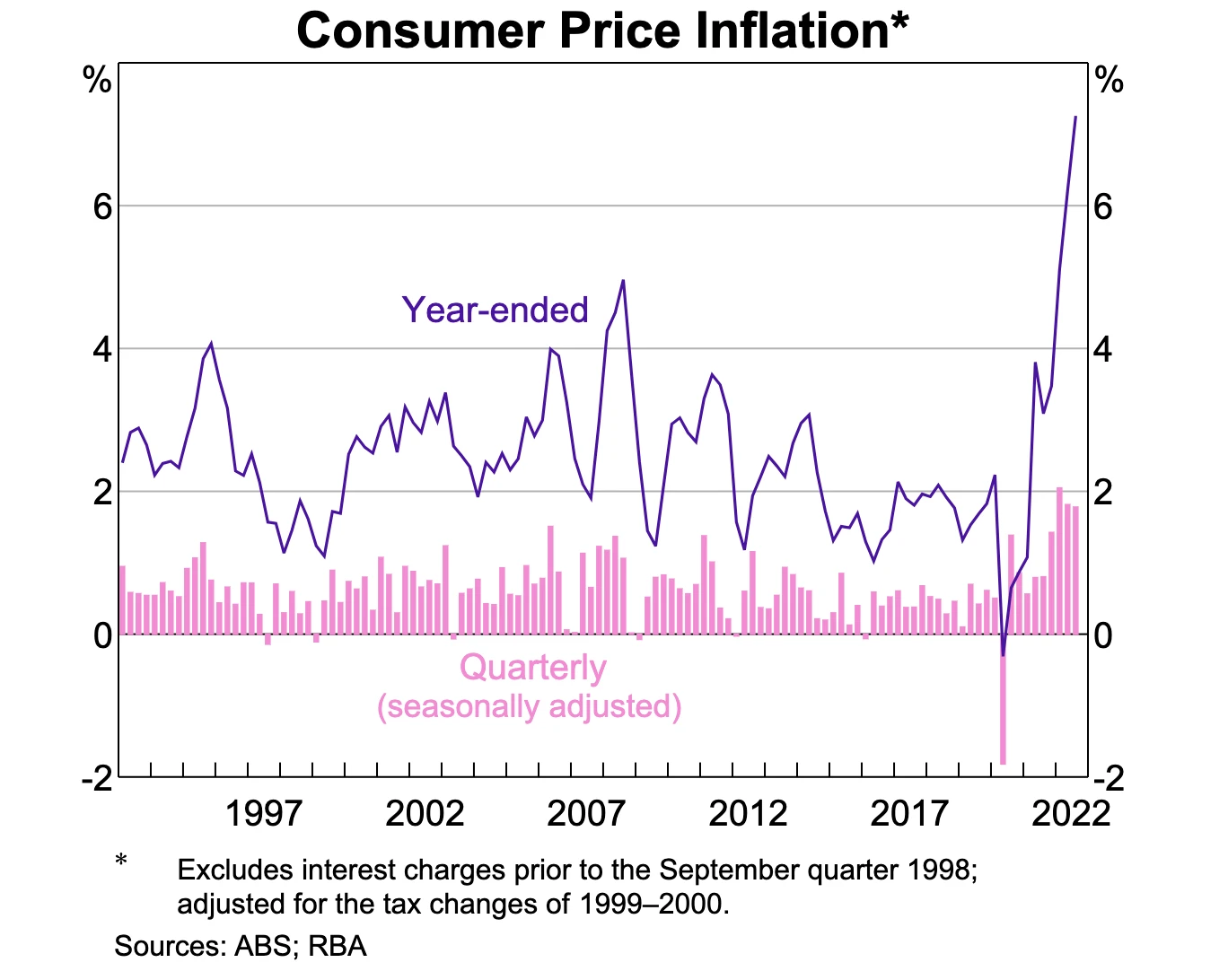

Just when you thought inflation was starting to slow down, it decides to reach a 32-year high

Following the release of the revised Federal Budget, it was reported that headline inflation rose by 1.8% in the September quarter, causing annual inflation to hit a 32-year high of 7.3%. With Halloween on the horizon, it is fair to say that this announcement gave the Australian population a ‘fright’. Despite projections earlier this year suggesting that inflation was to max out at 7% before re-stabilising, inflation seems to be on the up again, leading many to argue that the RBA will be forced to dish out another 0.50% interest rate hike in November.

To understand why inflation has experienced a minor spike toward the end of 2022, we need to direct our attention toward the price of tradable goods and services. As argued by Greg Jericho, leading economist for The Guardian, spikes in inflation are typically a result of prices determined domestically increasing. Goods and services, such as education and electricity, tend to rise in price faster than goods and services which have their price determined by global markets, such as electricity. This difference can be observed by a diagram produced by the AER, which reveals that the cost per megawatt hour of energy has risen from ~$30 to -$100 over the last twenty years.

Yet, as per the ABS, inflation is getting spooky, as inflation from prices determined internationally are driving inflation, contrary to what is usually expected of inflation. The prices of “tradable” goods and services have increased by 8.7% in the past year, compared to a mere 6.5% for non-tradables. Whilst it was argued earlier that higher inflation would lead the RBA to pursue a 0.50% interest rate hike, the effects of interest rate changes generally fail to trickle down to goods and services that have their price determined by overseas economic conditions. Since the RBA’s cash rate changes directly influence domestic economic conditions, the RBA may lose their control over domestic inflation if the price of tradable goods and services continues to soar.

Furthermore, when we get deeper into the recent change in inflation, it can be observed that the prices of non-discretionary items are increasing at a faster rate than discretionary items. As Greg Jericho puts it, “the price of things you can’t avoid paying are rising faster” than things you can avoid purchasing. Whilst petrol prices have fallen over the course of 2022, largely due to the halving of the petrol excise tax earlier in the year, they remain 40 cents a litre above their pre-pandemic level. This is a primary example of why the Australian population should not be celebrating the recent price drops that we have seen for house prices and petrol, since inflation has still increased dramatically when compared to pre-pandemic levels.