This week, as lockdowns continue to place a large damper on economic recovery, we have an opportunity to look at the long term trends that will affect the Australian economy in the next few decades. In particular, we have an opportunity to study the Current Account surplus (CAS), the effects of an ageing population and examine how these will affect the structure of the economy in terms of which industries will rise and those that will decline.

1. Current account surplus gives Australian economy breathing room, says Bank of America

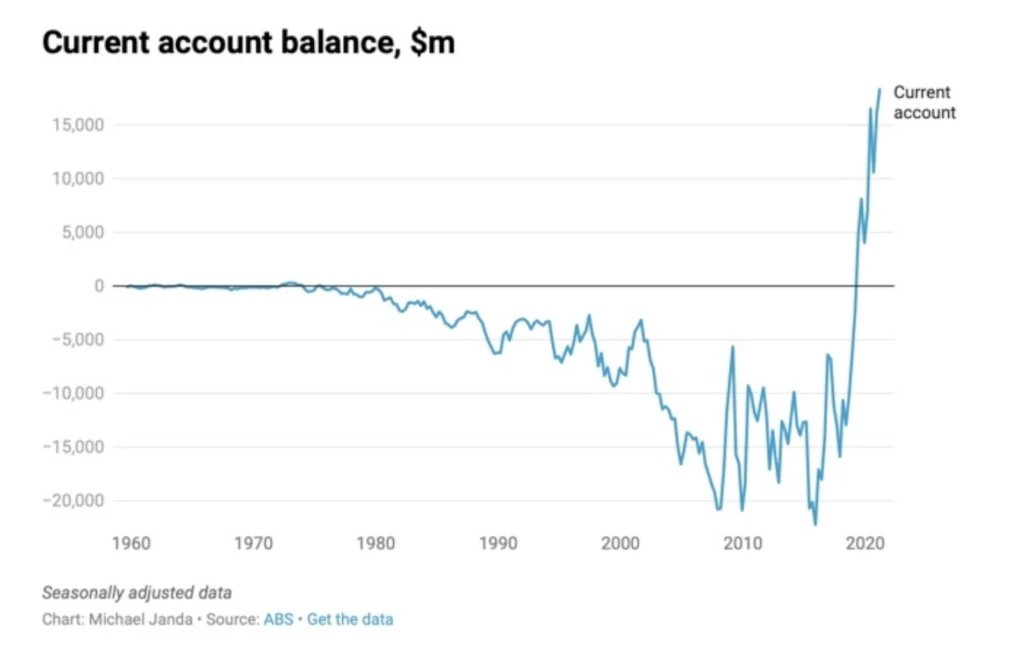

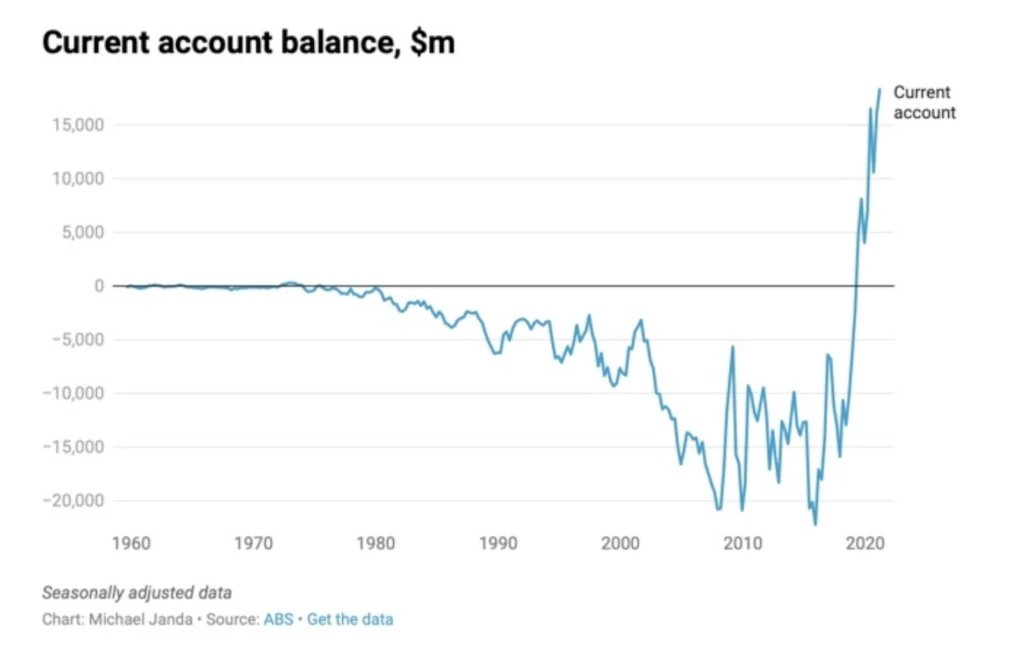

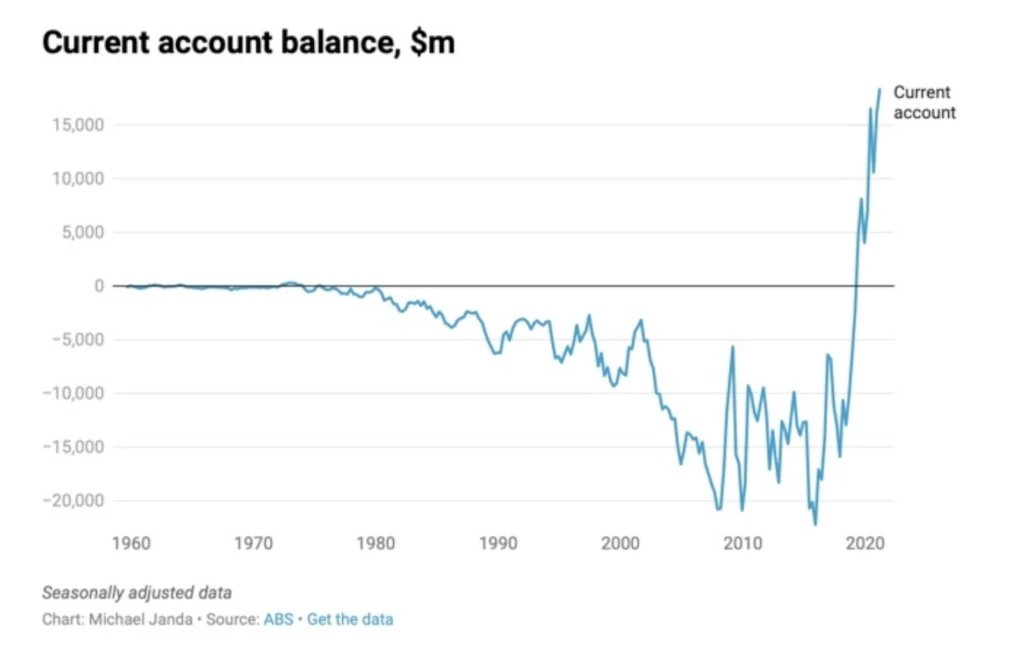

Australia’s Balance of Payments has been experiencing an unusually positive period in recent quarters. For the first time since 1975, we have maintained and increased a Current Account surplus (CAS). A CAS indicates that in terms of exports and imports, our economy is earning a positive amount of income from two-way international trade, and money is being injected, not leaked from our economy!

Source: https://www.rba.gov.au/education/resources/explainers/trends-in-australias-balance-of-payments.html

This situation comes following some of our largest ever current account deficits after the Mining Investment Boom in 2011 (not to be confused with the original mining boom starting in 2003).

As the Bank of America notes, this particular phenomenon allows Australia “a bit of breathing room” in terms of economic expansion. Moreover, “We’re actually in a position now where we can recycle some of those earnings domestically or, you can see with the growth in superannuation funds as well, some of those investments are recycled overseas”.

In other words, the injections into our economy are giving local firms the opportunity to create an even greater volume of economic activity by re-investing the profit into the economy.

For further studying, read through these articles: https://www.abc.net.au/radionational/programs/rearvision/the-mining-boom-that-changed-australia/7319586

https://www.abc.net.au/news/2021-07-01/current-account-surplus-gives-australian-economy-breathing-room/100256222

How does this apply to HSC economics?

Well firstly, it provides evidence to support the Pitchford thesis; the fact that our export and investment rates increased following the huge inflow of money [via our KAFA (Capital and Financial Account) during the MIB (Mining Investment Boom)], supports the idea that our economy was able to increase investment and export production using the income earned from the MIB.

Moreover, the dramatically increased income earned from LNG, Commodities and Services exports provide domestic firms with more money to invest. This can be used to further reduce outflows on the Net Primary Income (NPY) account by allowing local businesses to find local investors/sources of investment, reducing reliance on foreign investment money and thus helping to close the Savings-Investment Gap that has plagued Australia for so long.

For revision on the Balance of Payments and the Current, Capital and Financial Accounts that fall under it, check this handy website out!

https://www.rba.gov.au/education/resources/explainers/the-balance-of-payments.html

The Australian Savings-Investment Gap is a concept that describes how the Australian economy has had a structurally high CAD due to local firms being unable to find domestic investors with enough funds to cover the majority of their investment needs for a long time.

The biggest local investors in Australia are our banks and other financial organisations, but ordinary Australian households do not deposit enough savings with the banks for them to be able to cover the investment that our economy needs to expand, i.e. local banks alone do not have enough money to cover the full cost of investing into billion-dollar projects e.g. new mines by BHP Billiton, or a government rail infrastructure project needed to develop rural NSW.

This forces local firms to look overseas for investors. When invested into by overseas investors, the firms in the Australian economy must pay dividends to foreign investors, representing money that is leaked from the Australian economy, thus increasing the CAD via NPY debit payments.

Here are articles explaining the Savings and Investment Gap:

https://www.dfat.gov.au/trade/investment/the-benefits-of-foreign-investment

https://www.rba.gov.au/publications/bulletin/2012/mar/2.html

Continuing on, if Australians continue to invest heavily overseas, we will have a further increase in credits on our NPY as dividends and profits flood in from overseas.

In the long term, this may help us to structurally sustain a Current Account Surplus even when our terms of trade collapses. Overall, this CAS allows us to write about an incredibly unique period in the Australian economy, as the ABC notes “Since the ABS started publishing the figures in September 1959, Australia has run 221 quarterly deficits to just 26 surpluses”.

Just for context 8 of those have come in the most recent times!

HSC application:

- Since September 1959, Australia has run 221 quarterly deficits compared to just 26 surplus.

- Iron ore has risen above $200 a tonne, a seismic rise.

- Australia’s 20% savings rate in covid has helped to reduce our savings-investment gap and improve our investment rate overseas.

Note: the term “structural” in economics is used to convey features of an economic concept that are caused by long-term factors which are often hard to quickly change.

If you have any more questions, come sign up at Project Academy to access our tutors who are ready to answer your questions online, one-on-one, every day until 11pm!

https://www.projectacademy.com.au

2. Three key predictions for Australia’s future: highlights from the Intergenerational Report

The Boomer economy is on its way to bite us in coming decades, as Australians get older and the wealthiest generation in modern times starts to move into aged care facilities, we will continue to see a concerning structural shift in the economy.

As the Guardian notes “between 2019-20 and 2060-61, the number of Australians aged 65 and older will double to 8.9 million.”

Generally, this will mean two things for our economy:

Firstly, as the number of people who require aged care pensions rises, the government has to spend a much greater amount on welfare payments to this growing population of unemployed or retired people.

Secondly, the AUD81.8 Billion healthcare industry is likely to boom in the coming decades, as the structure of the economy shifts towards providing services to an increasingly old population.

However, some have noted that Australia’s pioneering superannuation system is likely to counter some of these issues, by allowing the Government to spend less on pensions in the next 50 years than if the superannuation system didn’t exist.

This is because those who are set to retire in the near future have built up a massive $2.7 Trillion worth of superannuation money in total. All in all, an ageing population provides for some major but potentially non-dire shifts in our economy.

HSC application:

- The current super system already has 2.7 Trillion dollars floating around, and will help bridge the Savings and investment gap.

- The population of Australians 65 and older will double to 8.9 million by 2060, creating immense structural change to our economy as spending patterns change and demand for goods and services suited to elderly people increases.

…

This series of weekly articles aims to compile the important economic news of the week into bite-sized summaries with HSC-specific takeaways.

You can expect a new article every Monday!