After a year of debate about rising house prices amidst the COVID-19 pandemic, house prices in Australia are finally starting to fall. Rising interest rates and an increased cost of borrowing have led to a declining number of aspiring housebuyers, as the cost of mortgage repayments increases at a faster rate than ever. Whilst house prices are declining, they are still higher than compared to what we saw prior to COVID-19. This fortnight’s article will question whether house prices will fall below pre-COVID-19 levels. And if house prices continue to fall at such a rate, this fortnight’s article will analyse recent comments made by several notable economic and finance commentators in Australia, questioning whether a recession is on the horizon.

Houses are becoming more affordable, but will house prices ever fall below pre-COVID levels?

With interest rates on the rise, Australians are anticipating house prices to plummet as the cost of borrowing becomes increasingly expensive and aspiring houseowners become unwilling to invest. Whilst changes in monetary policy are said to have a 6-18 month impact lag before noticeable effects on the Australian economy, house prices have been impacted immediately. The ABS tells us that the total value of residential dwellings in Australia fell by $162.4B to a total of $9,983.4B this quarter.

Importantly, the mean price of residential dwellings has fallen by $18,900 to $921,500 this quarter. This is good news for aspiring homebuyers, especially for those in NSW, where dwelling prices have fallen by 3.8% in the June quarter. Whilst this all looks very promising and signals a downward trajectory for dwelling prices, annual growth in dwelling prices remains excessively high when compared to historical trends. Back in September 2016, dwelling prices increased by 3% annually. However, in December 2021, dwelling prices are said to have increased by 25% annually. As lockdown measures were relinquished and investor confidence regained its strength, housebuyers flooded the market and aggravated never-seen-before demand for houses.

Greg Jericho, an economist for The Guardian, notes that the Federal Government’s HomeBuilder scheme has also contributed to the drastic increase in housing prices over the last two years. Easy-to-access grants and a low cash rate of 0.25% in June 2020 set the tone for rampant house buying, with the median house price in Sydney rising by $324,000 since the scheme was introduced.

However, looking at the current price decreases, Peter Hannam of The Guardian contends that houses are far more likely to be affected by the aforementioned price decreases relative to apartments. Backed up by data from CoreLogic, Hannam claims that higher-priced properties are experiencing more significant falls in value in most capital cities in Australia. CoreLogic data also shows that swings in housing prices tend to be more significant than that of units/apartments, with house prices rising by 30% from the trough to the peak compared to 13.2% for units. This proves that houseowners and aspiring houseowners tend to be more reactive to changes in interest rates and general economic conditions, meaning that the price of houses tends to fluctuate more.

As was mentioned before, house prices are decreasing. Yet, when compared to historical trends, annual growth in house prices remains high. Will house prices actually fall below COVID levels and alter the annual growth trend? Phillip Lowe doesn’t think so. Phillip Lowe argued last week that a 10% fall in house prices is to be expected. Even if this occurs, house prices would remain on average 15% higher than before the pandemic. So, it’s unlikely that they will fall below COVID-19 levels (for now).

Enjoying Project Academy’s Economics content? Come enrol in our year 12 and year 11 Economics courses!

Now that house prices are plummeting, is a recession likely to occur in the next few months?

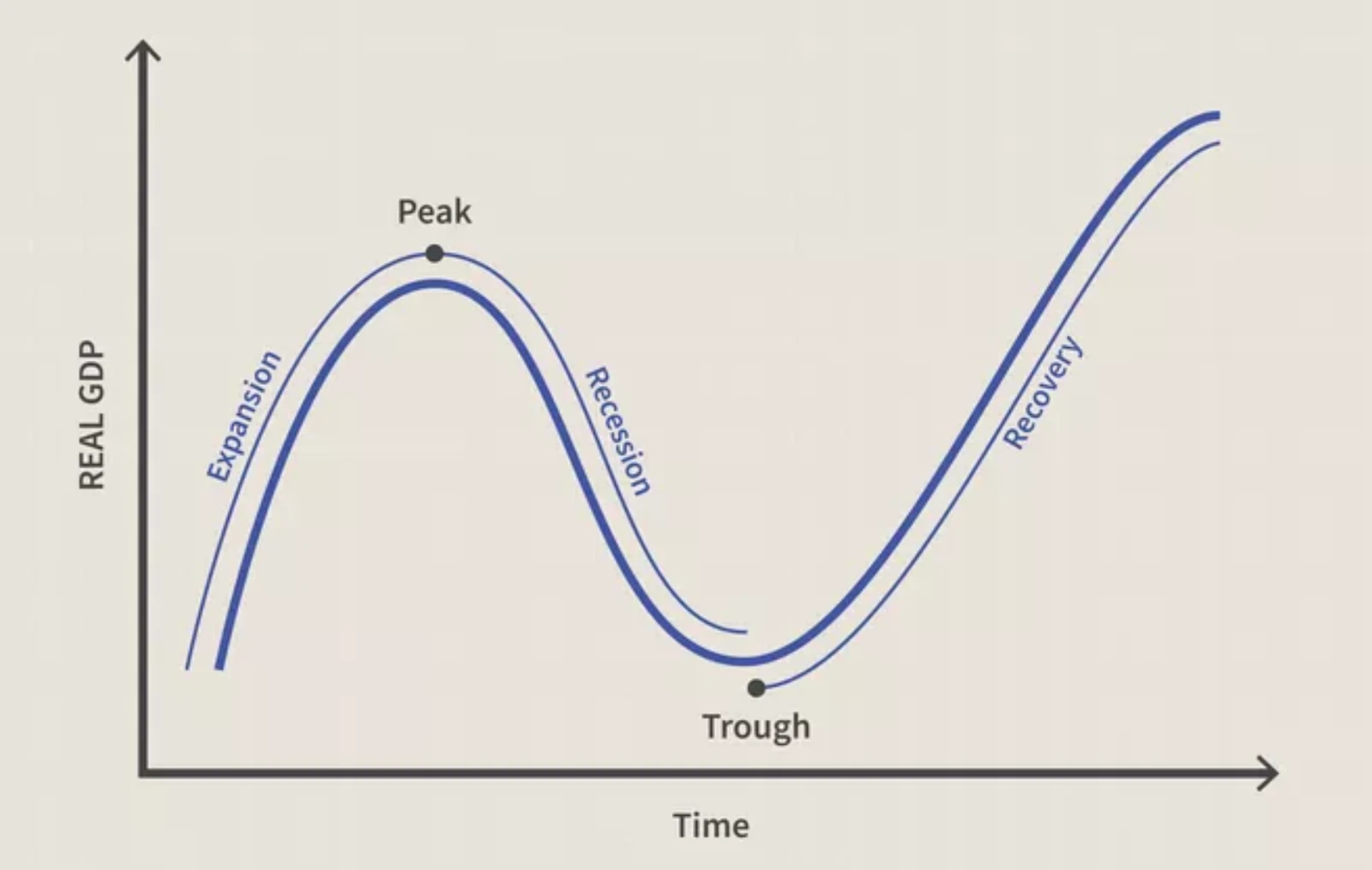

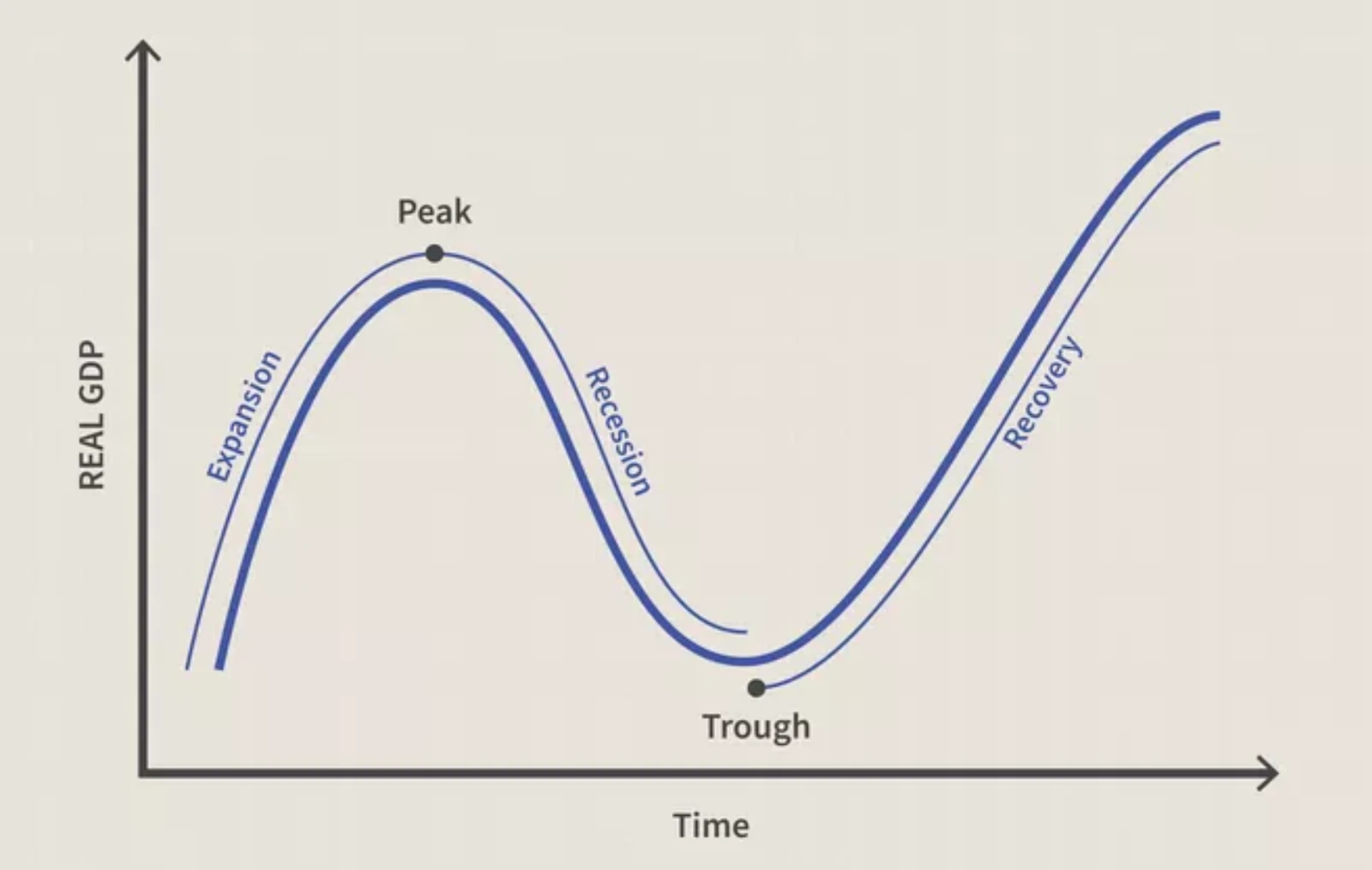

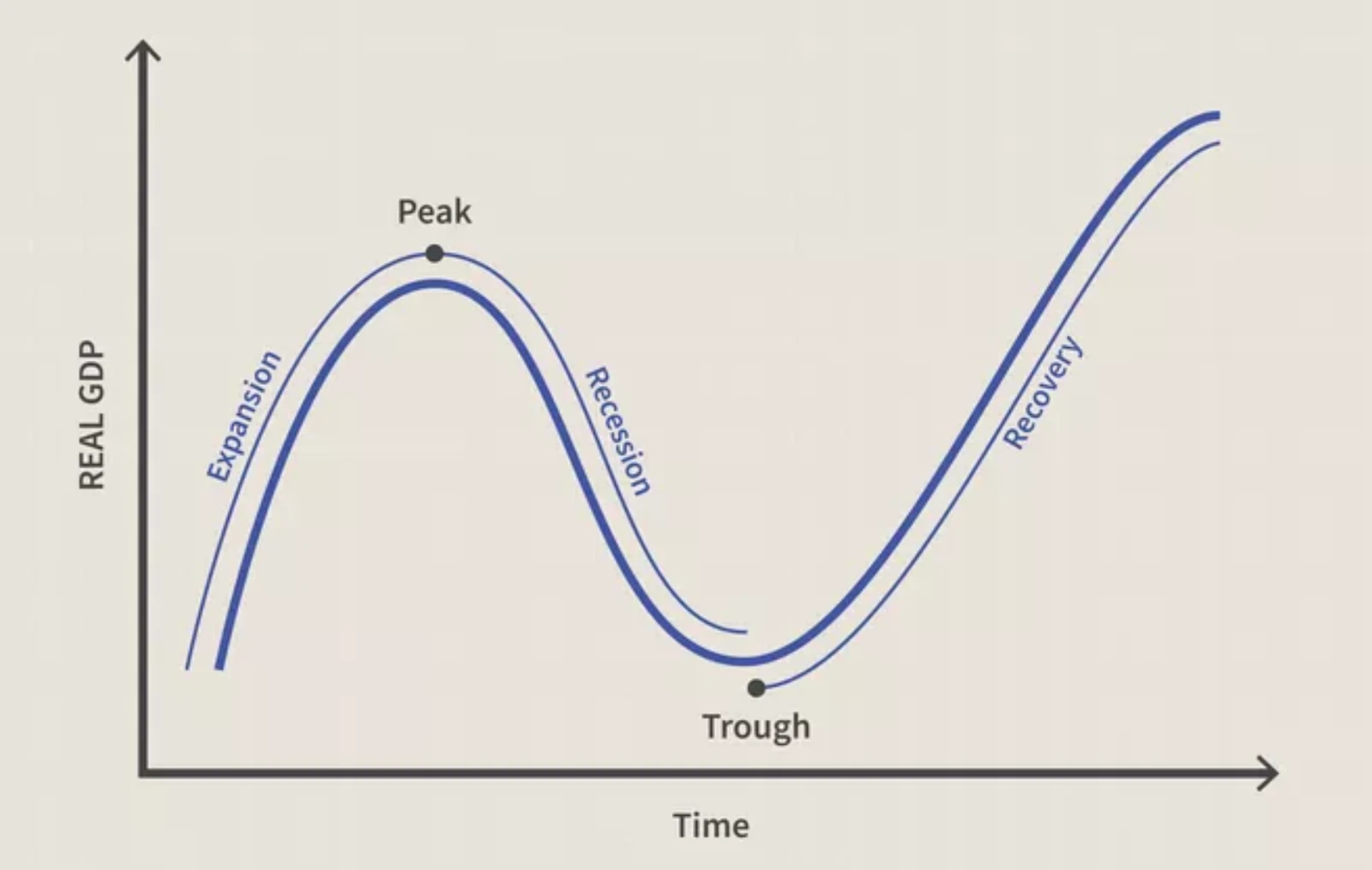

Whilst we do not expect house prices to fall below COVID-19 levels, the extent of recent decreases in house prices has led many to question whether Australia will suffer from a recession soon. One person asking this question is Barrenjoey chief economist, Jo Masters. Masters argues that the Australian economy will fall into a recession if interest rates continue to be hiked as aggressively as markets anticipate them.

Currently, the cash rate rests at 2.35%. Yet, Barrenjoey expects the RBA to stop raising rates once the cash rate hits 2.85%. According to the Australian Financial Review, this is inconsistent with current consensus estimates and is a mere 0.50% above its current level. Given that Phillip Lowe openly deliberated about a 0.25% to 0.50% interest rate hike last week, this expectation appears to be quite optimistic. This expectation is based on the idea that Sydney’s property market is “very leveraged” and that housing prices will continue to dwindle by approximately 3 to 5% if the RBA decides to raise the cash rate alongside current market expectations.

As such, calls for a recession are echoed by Bloomberg surveys, which show that the chance of a recession in the next year in Australia is 25%. Yet, this is nothing compared to the 60% chance in the UK and the 50% chance in the US. If this is the case and the US/UK fall into a recession, it significantly increases the chance of Australia falling into a recession as well.

Through the contagion effect that we saw during the GFC, an economic recession abroad tends to affect Australia negatively, as our integration into the international business cycle and continued trade with advanced economies make it harder to block external shocks. This has led Phillip Lowe to argue that growing overseas risks are “weighing on Australia’s economy”, ultimately making it harder to achieve a “soft landing”. Thus, it is hard to say whether Australia will suffer from a recession as it is entirely dependent on the rate at which the RBA decides to hike interest rates and overseas economic conditions.